When Selena launched her home-based apparel business, she faced a familiar fork in the road: should she open a small business credit card or apply for an unsecured business line of credit? Each path offered funding, flexibility, and potential but also risk, complexity, and fine print. The stakes were high: make the right move, and she would gain the financial breathing room her startup needed to scale. Choose wrong, and she could be buried under interest, fees, or worse, damaged personal credit.

Selena’s story mirrors a question every entrepreneur faces: What is the smartest financing option for your business right now? And thanks to the rise of AI-powered finance platforms, that decision does not have to be guesswork.

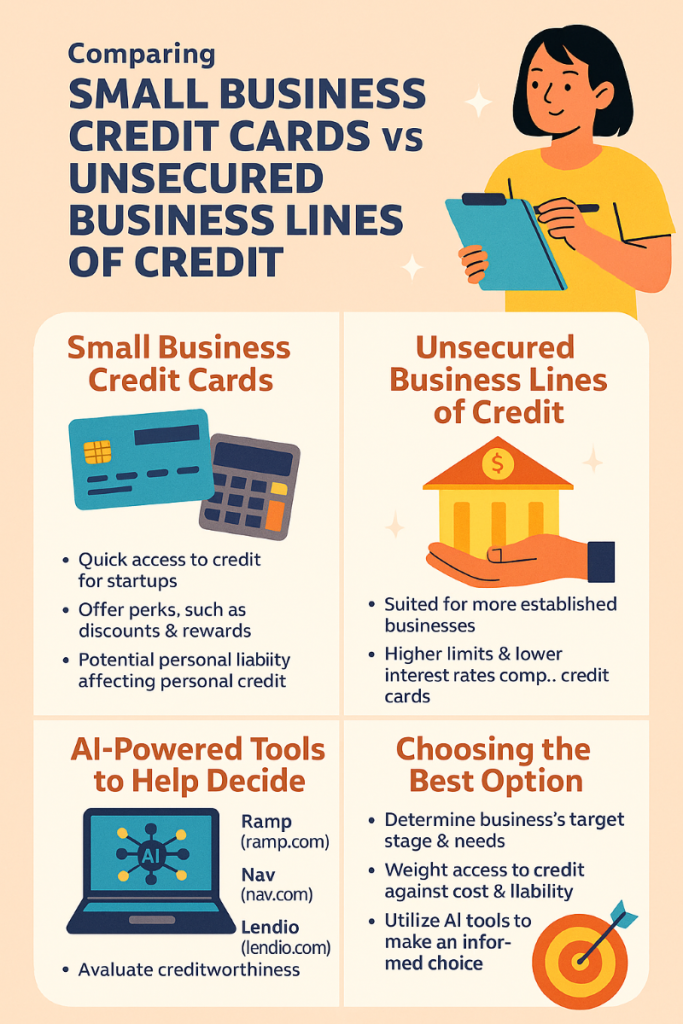

In this piece, we discuss the relative merits of a business credit card and an unsecured business line of credit, when it may be appropriate to use them, and how AI tools can help to do a comparative analysis of these two options in order to make an informed decision.

In addition to having business credit, it is important to master financial management strategies. If you want to learn how to manage, protect, and grow your income using practical financial strategies tailored for entrepreneurs, then click on the following link to join our free wealth upgrade membership club. Here, you will discover how to invest smarter, grow faster, and retire rich, in addition to getting the tools to keep track of your money so that you can keep more of what you earn.

Claim Your Free Silver Membership

Understanding the Small Business Credit Card

A small business credit card is a revolving line of credit designed for day-to-day operational expenses. For startups, freelancers, or sole proprietors, it is often the first taste of business financing, an accessible way to separate personal and business spending.

The appeal of a business credit card is speedy approval. Many cards offer instant approvals, online applications, and virtual cards that you can start using the same day. Brands like Brex and Ramp take it even further, using AI to evaluate real-time business performance—not just traditional credit scores—to approve applicants and set spending limits. This means even newly launched businesses with minimal credit history can qualify based on transaction volume or revenue projections.

For Selena, a home-based business apparel start-up owner, signing up for a credit card through Brex gives her immediate access to capital, without tying up personal savings. She would be able to launch her first paid ads, stock up on materials, and track every expense via AI-powered dashboards that auto-categorized purchases and flagged anomalies.

The Power—and Risk—of Personal Guarantees

Small business credit cards come with a catch that many founders overlook: the personal guarantee. In most cases, even if the card is issued in the name of your business, you are still personally liable for repayment. Some issuers report activity to personal credit bureaus, meaning late payments or maxed-out balances could affect your FICO score, even if the spending was strictly business-related.

Fortunately, AI can help you avoid costly missteps. Tools like Nav and Credit Karma for Business analyze your personal and business credit simultaneously, projecting how new accounts could impact both. They also alert you to which cards report to which bureaus, so you can prioritize options that protect your personal credit. Thanks to a Nav dashboard, a business owner will be able to quickly understand the impact of any error in reporting, dispute the error, and get back on track.

When Unsecured Business Lines of Credit Make Sense

In a typical business world, as your business grows and revenue stabilizes, your financing needs evolve. Ad campaigns get more expensive, and supplier orders increase. That is when you consider a more robust option: an unsecured business line of credit.

Unlike a credit card, a line of credit is typically offered by banks or fintech lenders and provides a lump sum you can draw from as needed. You pay interest only on what you use, and repayment terms are often longer. Plus, the credit limits are generally higher, and the interest rates, especially for established businesses, are lower than those of most credit cards.

For high-growth businesses with predictable cash flow and larger purchase needs, it can be a smarter option. But there is a tradeoff: to qualify, you will need a strong business credit profile, consistent revenue, and typically at least one to two years of operational history. Small business owners noticing growth and stabilized revenue may have to turn to Bluevine —a fintech lender that uses machine learning to assess loan applications.

Unlike some traditional banks, Bluevine evaluates real-time banking data and transaction patterns using AI, making faster, more accurate lending decisions. If a business qualifies and meets the lending criteria, it may be approved in a relatively short period of time for a line of credit at a competitive rate without having to put up collateral.

Using AI to Compare Options in Real Time

One of the hardest parts of choosing between a business credit card and a line of credit is the apples-to-oranges nature of the comparison. That is where platforms like Lendio and Fundera come in. These tools aggregate offers from multiple lenders, using AI to compare interest rates, repayment terms, annual fees, and approval odds in real time.

With these tools, you can upload your business financials and, within minutes, have side-by-side comparisons of credit cards and credit lines, each with personalized estimates based on your revenue, time in business, and projected spend.

This level of insight used to be reserved for businesses with full-time CFOs. Today, thanks to AI, even solo entrepreneurs can make data-backed financial decisions with the help of a tool like Lendio.

Credit Strategy Isn’t Just About Access—It’s About Control

The final and perhaps most important lesson here is that choosing a financing tool is just the start. The real power comes from how you manage it. Whether you are using a card or a line of credit, AI-powered spend management tools like Divvy and Ramp allow you to assign virtual cards to team members, set spending caps by category, and automate receipt capture.

The above-mentioned tools not only help keep your books clean, but they also prevent overspending and fraud. Platforms like Float even forecast your future cash flow based on historical spending trends, showing you when it is safe to use credit, and when it is smarter to hold off.

With the help of AI tools and the appropriate business financing, you can treat your business credit like an investment. You do not just have to swipe—You can plan, analyze, and optimize. This will enable you to sleep better knowing that you have got both flexibility and financial visibility in one streamlined system.

Before we conclude, if you are looking to make money online or have an online business that is completely done for you with ongoing support, then look no further. Click on the following link and learn more. To your success.

https://SteveAikinsOnline.com/survey.php

Conclusion: Smart Credit, Backed by Smarter Tools

There is no one-size-fits-all answer to the question of whether a small business credit card or unsecured line of credit is “better.” It depends on your stage of growth, your risk tolerance, and your goals. But what is clear is this: AI has leveled the playing field.

With tools that analyze your cash flow, compare lenders, protect your credit score, and automate spending oversight, today’s entrepreneurs can make financing decisions with confidence, not guesswork. The key is that as an entrepreneur with these tools at your disposal, you can build not just a business, but a system that starts with choosing the right credit, powered by the right technology.

The author, Stephen Aikins, has over two decades of experience working in various capacities in financial and business management, government, and academia. As a seasoned financial and management professional with a wealth of experience spanning diverse industries, he provides AI-powered digital solutions with data-driven insights to help enhance business growth. Additionally, he has prior experience offering strategic guidance and practical solutions to address a wide range of challenges and opportunities, including auditing and financial analysis, business planning, and organizational development.