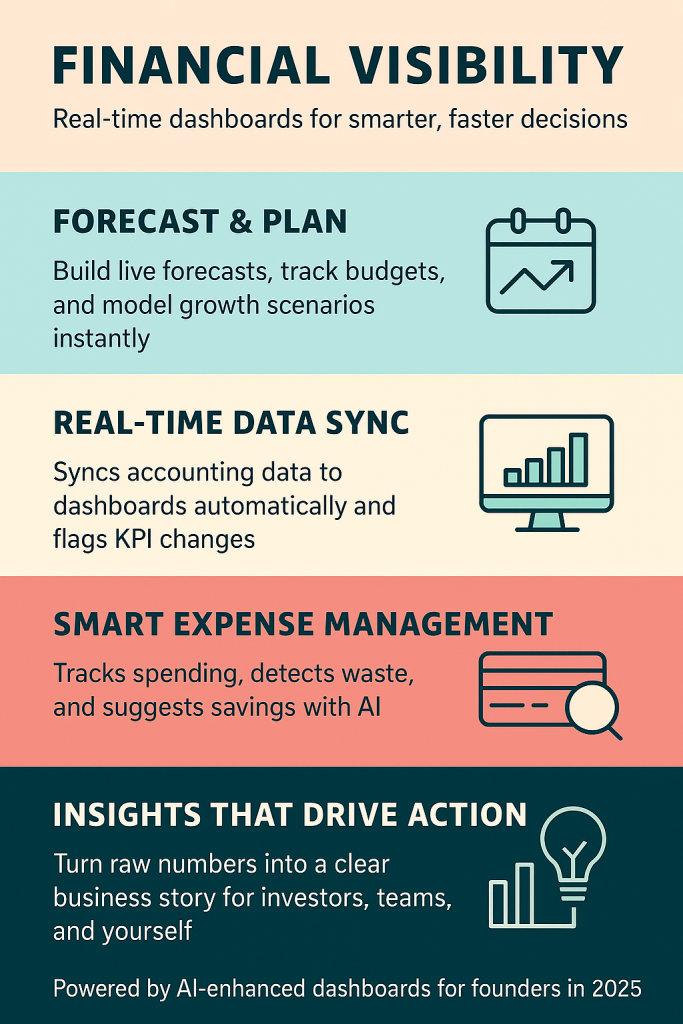

The early days of running a business can feel like driving a car without a dashboard. You are moving forward, making decisions on instinct, and hoping you do not run out of fuel or blow the engine. For founders, financial visibility is not just about knowing the balance in the bank. It is about having a real-time, comprehensive view of your company’s health so you can steer with confidence.

In the current AI economy, this visibility does not come from clunky spreadsheets or monthly reports delivered too late to be useful. It comes from AI-powered financial dashboards—interactive platforms that consolidate startup metrics, automate reporting, and give founders the insights they need to act quickly.

In this piece, we discuss the significance of financial dashboards, their role in enhancing a business’s financial visibility, performance tracking, and decision-making based on real-time data. Additionally, we discuss the types of AI tools that facilitate the creation of financial dashboards and some key performance indicators that can be measured with these dashboards for effective business decision-making.

Undoubtedly, having AI-assisted financial dashboard is very helpful. At the same time, you need human expert insights to manage your business finances successfully. If you want to learn how to manage, protect, and grow your income using practical financial strategies tailored for entrepreneurs, then click on the following link to join our free wealth upgrade membership club. Here, you will discover how to invest smarter, grow faster, and retire rich, in addition to getting the tools to keep track of your money so that you can keep more of what you earn.

Claim Your Free Silver Membership

Why Financial Dashboards Are No Longer Optional

For many founders, especially in startups, there is no CFO reviewing every transaction and preparing polished reports. Instead, decisions about hiring, product launches, or marketing spend often fall on the founder’s shoulders. Without a clear, real-time picture of cash flow, revenue, and expenses, these calls can be risky.

Traditional financial reporting has always been backward-looking. By the time you receive last month’s performance summary, the opportunity to correct course has passed. Financial dashboards flip this dynamic. With real-time data streams and AI analytics, founders can see what is happening right now and even project what is likely to happen next.

Platforms like Finmark are designed specifically for startups and growing businesses. They pull in financial data, operational metrics, and even hiring plans to create a dynamic forecast. The dashboard becomes not just a record of what has happened, but a living model that updates as your assumptions change.

The Power of AI in Business Performance Tracking

The modern financial dashboard is more than a pretty set of graphs. AI analytics tools add depth and intelligence to the numbers, spotting anomalies, forecasting trends, and even suggesting actions. This means founders no longer have to manually sift through mountains of data. They can focus on interpreting insights and making decisions.

Take LiveFlow, for example. It integrates directly with your accounting platform and Google Sheets, updating your reports in real time without manual imports. But the real magic is in its AI-enhanced analysis, which identifies changes in spending patterns or sudden shifts in key performance indicators (KPIs). If marketing spend spikes or recurring revenue dips, you do not have to wait until month-end to notice.

Similarly, Ramp combines spend management with advanced analytics. It does not just track expenses; it uses AI to detect duplicate charges, negotiate better vendor rates, and flag potential overspending before it eats into cash reserves. For a founder juggling multiple roles, having this kind of smart monitoring built into the dashboard is like having a co-pilot scanning the horizon for turbulence.

What to Measure: The Core Startup Metrics

A dashboard is only as good as the metrics it tracks. While every business will have unique KPIs, there are core indicators that most founders should monitor in real time. Revenue and expenses are obvious starting points, but for startups, more nuanced measures can make or break strategic decisions.

For example, cash runway—how many months you can operate before funds run out—is crucial for knowing when to raise capital. Customer acquisition cost (CAC) and lifetime value (LTV) help evaluate the efficiency of marketing and sales. Monthly recurring revenue (MRR), gross margin, and burn rate reveal whether growth is sustainable or if you are scaling too quickly.

LTV refers to the total revenue a customer is expected to generate for a business throughout their entire relationship. LTV helps businesses to understand the long-term value of their customers, guiding decisions about marketing, budgeting, and customer retention. Burn rate is the rate at which a business spends its capital to cover expenses before generating positive cash flow. Understanding burn rate helps assess financial stability and the timeframe before additional funding is needed.

What makes AI-powered dashboards different is that they do not just display these numbers; they contextualize them. If your burn rate is climbing, the system can highlight which expense categories are driving it. If LTV is dropping, AI can point to changes in customer retention or upsell rates.

From Numbers to Narrative: Turning Data into Decisions

One of the overlooked benefits of financial dashboards is their ability to communicate the business’s story, not just to founders, but to investors, team members, and other stakeholders.

For example, when preparing for a pitch meeting, a founder can use Finmark to show a visual projection of growth over the next 18 months, complete with hiring milestones and capital requirements. Or, a LiveFlow report might make it instantly clear how a recent marketing campaign improved MRR while keeping CAC in check.

Dashboards remove the friction of gathering, cleaning, and presenting data. Instead, they empower founders to spend more time on strategy, making decisions based on live insights rather than outdated reports.

The Competitive Advantage of Real-Time Visibility

In a fast-moving market, being able to respond quickly is a competitive advantage. If a key supplier raises prices unexpectedly, a founder with a real-time dashboard can instantly see the impact on margins and adjust pricing or sourcing strategies. If a sudden sales surge threatens to strain cash reserves, Ramp can flag the risk early, giving time to secure short-term financing or delay certain expenses.

In this way, financial dashboards act as both an early warning system and a growth accelerator. They help protect against avoidable crises while creating confidence to act on opportunities as they arise.

Integrating Dashboards into the Founder’s Daily Workflow

Adopting a financial dashboard is not a one-time setup but rather an ongoing habit. The most effective founders treat their dashboards like mission control, checking them daily and using them to guide decisions big and small.

Integration is key. Platforms like LiveFlow and Ramp work best when connected to your accounting software, Customer Relationship Management (CRM), and even payroll systems. This ensures the data is always fresh and eliminates the need for manual updates. AI algorithms then layer in projections and recommendations, making the dashboard not just a reflection of the present, but a window into the future.

Over time, this practice transforms financial visibility from an occasional review into a continuous state of awareness. Founders stop reacting to problems after they occur and start managing proactively, with a clear, data-driven vision for the path ahead.

Before we continue, if you are looking to make money online or to have an online business that is Done For You with ongoing support, then look no further. Click on the following link and learn more. To your success.

https://SteveAikinsOnline.com/survey.php

Conclusion: The Future of Founder-Friendly Financial Dashboards

As AI continues to advance, financial dashboards will become even more personalized. Imagine a system that not only tracks and forecasts your startup metrics but also simulates “what-if” scenarios in real time, suggesting the best moves to reach your goals. That is where platforms like Finmark, LiveFlow, and Ramp are heading—toward being full-fledged financial copilots for founders.

In the modern business landscape, visibility is more than a nice-to-have; it is a survival tool. The founders who embrace real-time, AI-enhanced dashboards will be the ones who navigate uncertainty with agility, seize opportunities faster, and scale with confidence. For anyone steering a growing business, the message is clear: stop flying blind and start building your mission control.

The author, Stephen Aikins, has over two decades of experience working in various capacities in financial and business management, government, and academia. As a seasoned financial and management professional with a wealth of experience spanning diverse industries, he provides AI-powered digital solutions with data-driven insights to help enhance business growth. Additionally, he has prior experience offering strategic guidance and practical solutions to address a wide range of challenges and opportunities, including auditing and financial analysis, business planning, and organizational development.

The information presented in this blog is based on the author’s independent research and is for educational purposes only. At the time of writing, the author is not affiliated with any vendors of the AI tools and platforms mentioned in this blog. The links to these AI tools and platforms have been presented in the blog to enable readers to access, research, and make their own informed decisions.