For decades, getting a business loan meant gathering stacks of paperwork, meeting with a banker, and hoping your credit score met the magic number. Many small business owners still picture lending as a rigid process dominated by old-school underwriting formulas and slow approvals. But in this AI era, the world of business loan approval has been transformed by fintech lenders, AI-driven risk scoring, and real-time data analysis.

If you are still operating under outdated assumptions about lender requirements, you may be missing out on funding opportunities that are faster, more flexible, and more data-driven than ever.

In this piece, we discuss the rapidly changing landscape of business lending, characterized by speed, AI-driven risk scoring, and real-time data that enable lenders to review a wider range of business health metrics for more effective funding decisions. Additionally, we discuss some of the AI tools that are revolutionizing the business lending landscape and provide links to these tools.

Before we continue, if you are a business owner struggling with sales, or want to make money online and need free training tools and tactics to set your business on the path to success and profitability, click on the following link to join our free membership clubs. Whether you are stuck on traffic, struggling with content, or do not even know what to sell, there is a solution here.

From Static to Dynamic: How Lender Requirements Have Changed

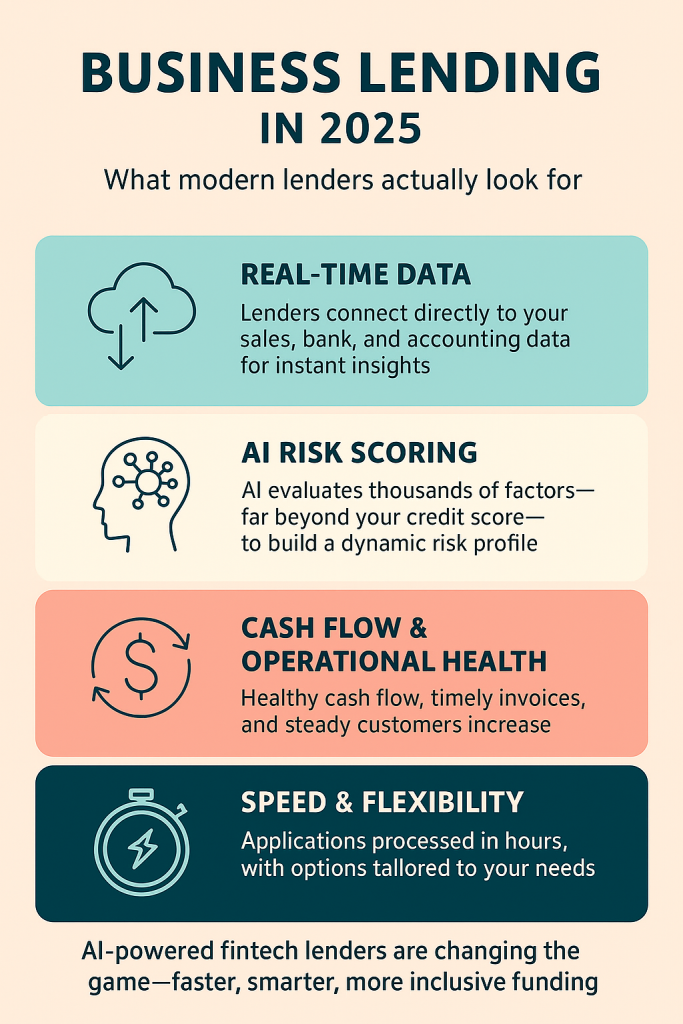

Traditional bank lending relied heavily on a handful of static measures—personal and business credit scores, collateral, and tax returns from the previous two years. While these factors still matter, modern small business underwriting has shifted to include a wider range of business health metrics.

Today’s lenders, especially in the fintech space, look beyond past performance and focus on your company’s current and projected financial health. They want to see how you are performing right now and how sustainable your growth is.

Platforms like Kabbage by American Express analyze real-time sales data, payment processing history, and even seasonal trends to determine your loan eligibility. Instead of waiting weeks for approval, their AI algorithms can issue funding decisions in hours.

The Rise of AI Risk Scoring

One of the biggest shifts in AI era lending is the use of AI-powered risk scoring. Rather than relying solely on human underwriters, many lenders now deploy machine learning models that evaluate thousands of variables at once, far more than a person could process.

These AI models take into account transaction data from your accounting software, customer payment patterns, inventory turnover rates, and even social proof signals like online reviews. The result is a risk profile that is far more nuanced than the traditional “credit score plus collateral” model.

OnDeck is a prime example. Its AI-driven platform not only speeds up loan approvals but also dynamically adjusts borrowing limits based on your current performance. If your revenue spikes, your available credit can increase automatically, no new application required.

Real-Time Data as a Trust Factor

Lenders want to minimize risk, and one of the best ways to do that is by having constant visibility into a borrower’s financial performance. This is why fintech lenders often require integration with your point of sale (POS) system, accounting software, or business bank account.

For example, BlueVine connects directly to your bank and accounting platforms to monitor cash flow in real time. This not only streamlines the application process but also allows for continuous risk assessment. If your business maintains healthy cash reserves and consistent revenue, your standing with the lender improves, sometimes unlocking better rates and higher limits.

The New “Soft Metrics” Lenders Watch

Beyond the numbers, modern lenders also pay attention to qualitative indicators of stability and growth potential. Customer churn rate, average invoice payment times, and employee turnover can all influence loan decisions. AI tools now make it possible for lenders to assess these factors automatically.

Fundbox, for example, uses AI to evaluate your customer payment behavior. If your clients consistently pay invoices early or on time, it signals lower credit risk even if your traditional credit score is not perfect.

This shift means that small business owners with less-than-ideal credit histories can still qualify for funding if they can demonstrate strong operational health.

Why Speed Matters in the New Lending Landscape

In the past, the biggest frustration for borrowers was the wait time between application and approval. Today’s fintech lenders know that speed is a competitive advantage. They leverage automation to process applications in hours, not weeks, allowing business owners to act on opportunities quickly.

AI-powered verification tools, like those used by Lendio, can scan documents, verify identity, and check compliance almost instantly. This means you can apply for multiple funding products at once and choose the one with the best terms without getting buried in paperwork.

Preparing Your Business for Modern Underwriting

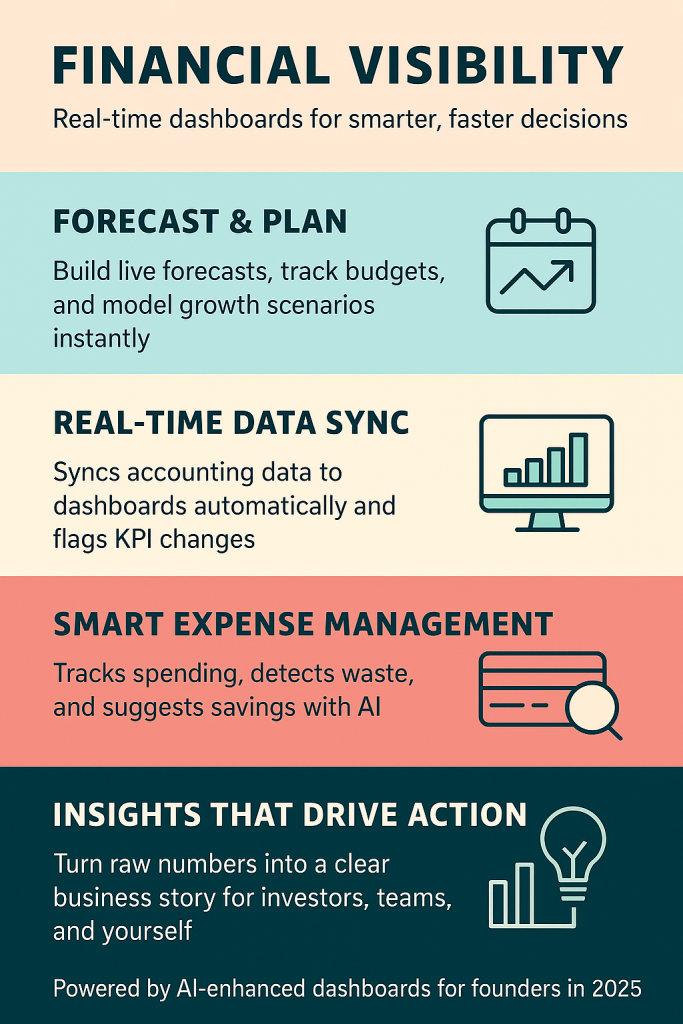

The good news for business owners is that preparing for a loan in 2025 is not just about polishing your credit score. It is about maintaining a healthy, transparent, and data-rich financial profile.

Start by connecting your accounting software to a platform like QuickBooks Online Advanced, which uses AI to categorize transactions, flag anomalies, and generate reports lenders love. Make sure your POS system and invoicing tools are consistent and up to date.

It is equally important to track your key metrics. Tools like Fathom not only provide performance dashboards but also make it easier to share your financial health story with lenders in a visually compelling way.

The Role of Relationship in a Digital Era

While automation is reshaping business lending, relationships still matter. Many fintech lenders assign account managers to help borrowers navigate funding options and repayment schedules. Combining AI’s speed and accuracy with human guidance creates a balanced, borrower-friendly experience.

Some platforms even use AI to personalize these relationships. Brex, for example, tailors credit limits and spending controls based on your company’s real-time financial behavior, while still offering direct access to support teams when you need it.

Before we conclude, if you are looking to start an online business that is Done For You with ongoing support, or you want to make money online but do not know where to start, then look no further. Click on the following link and learn more. To your success.

https://SteveAikinsOnline.com/survey.php

Conclusion: The Future of Small Business Lending

Based on the foregoing, the trajectory is clear that business lending is becoming faster, more data-driven, and more inclusive. As AI models continue to improve, lenders will be able to assess risk with even greater precision, making it easier for healthy businesses to secure funding regardless of size or industry.

For founders and small business owners, the takeaway is simple: stay connected, stay transparent, and embrace the tools lenders use to evaluate you. By aligning your operations with the new rules of lending, you not only improve your odds of approval but also position your business for sustainable, well-funded growth.

ABOUT THE AUTHOR

The author, Stephen Aikins, has over two decades of experience working in various capacities in financial and business management, government, and academia. As a seasoned financial and management professional with a wealth of experience spanning diverse industries, he provides AI-powered digital solutions with data-driven insights to help enhance business growth. Additionally, he has prior experience offering strategic guidance and practical solutions to address a wide range of challenges and opportunities, including auditing and financial analysis, business planning, and organizational development.

The information presented in this blog is based on the author’s independent research and is for educational purposes only. At the time of writing, the author is not affiliated with any vendors of the AI tools and platforms mentioned in this blog. The links to these AI tools and platforms have been presented in the blog to enable readers to access, research, and make their own informed decisions.