For decades, budgeting has been the dreaded annual ritual for business owners and finance teams. Endless spreadsheets, static forecasts, and the inevitable reality that numbers become outdated the moment they are finalized have made budgeting feel like an exercise in futility. But in today’s AI-driven economy, manual budgeting is giving way to something smarter: predictive forecasting powered by automation. The shift is not just about saving time; it is about gaining a competitive edge in how businesses plan, adapt, and grow.

In this piece, we guide you through the advantages and benefits of AI-powered budgeting, beginning with the shortcomings of manual budgeting and how AI tools help overcome these deficiencies to enhance automated planning for growing startups. You will learn that given the ability of AI-powered budgeting tools to learn from historical data, track live performance, and adjust projections instantly to help make proactive decisions, businesses that embrace these tools are the ones that can compete favorably in this AI-economy.

Before we continue, if you are looking to start an online business that is Done For You with ongoing support, or you want to make money online but do not know where to start, then look no further. Click on the following link and learn more. To your success.

https://SteveAikinsOnline.com/survey.php

The Problem with Manual Budgeting

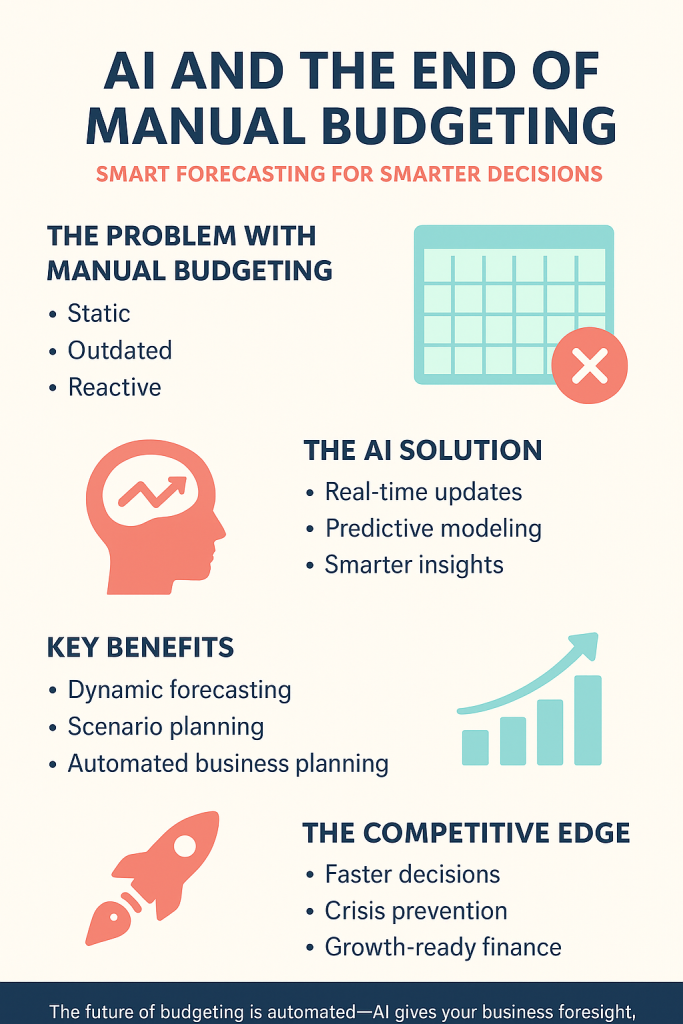

Traditional budgeting has always struggled with two major flaws: it is static and it is backward-looking. Companies set budgets based on past performance, but markets, consumer behavior, and supply chains do not operate in straight lines. A sudden dip in sales or a spike in costs can make a carefully built budget irrelevant overnight. Worse, by the time finance teams gather data, reconcile numbers, and update spreadsheets, opportunities may already have passed by.

In a startup environment where agility determines survival, this approach no longer works. Founders need financial forecasting that adapts in real time and helps them make proactive decisions. This is where AI budgeting tools are changing the game.

Enter AI Budgeting Tools

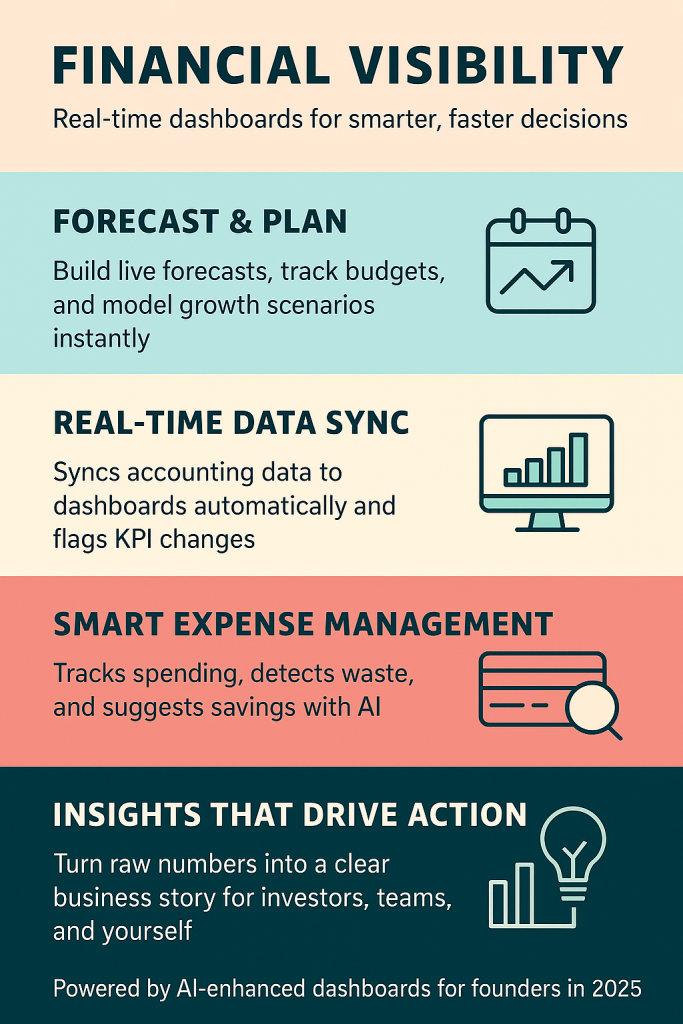

AI budgeting tools combine machine learning with financial modeling to deliver forecasts that are not frozen in time; they evolve as your business does. Instead of manually inputting assumptions and trying to anticipate every possible scenario, business owners can rely on intelligent platforms that learn from historical data, track live performance, and adjust projections on the fly.

Tools like LivePlan have reimagined budgeting by moving away from static spreadsheets. LivePlan uses AI to simplify financial forecasting, blending real-time business metrics with predictive insights. For startups that may lack a full finance department, it essentially acts as a co-pilot, guiding you toward realistic projections and helping you adjust plans as circumstances shift.

Forecasting Beyond the Spreadsheet

The real breakthrough of AI-powered financial forecasting is how it transforms planning into a continuous process rather than an annual event. Platforms like Finmark exemplify this shift. Instead of locking budgets into a rigid framework, Finmark creates dynamic models that can instantly reflect changes in customer acquisition, churn, or revenue streams.

If your business suddenly gains a new client or faces a drop in recurring revenue, the forecast updates in real time. That kind of agility ensures business leaders do not just react to surprises—they anticipate them. Finmark also connects with accounting and customer relationship management (CRM) systems, which means forecasts are grounded in live operational data, not just past results. For founders navigating uncertain markets, this level of financial visibility is not just a convenience; it is survival.

Smarter Scenarios, Smarter Decisions

Another advantage of AI budgeting tools is scenario planning. Traditional budgeting rarely allows for flexible what-if models without hours of manual rework. With automation, however, scenario building becomes fast and intuitive.

Take Brixx, a platform designed for startups and small businesses. Brixx enables leaders to build multiple scenarios—what happens if you hire two new employees, launch in a new market, or experience a 20% drop in sales? Instead of combing through hundreds of spreadsheet cells, Brixx adjusts the entire financial model instantly.

This predictive power changes the way businesses plan. Instead of one static budget, companies can maintain several live strategies, ready to deploy depending on market shifts. That agility is what gives small businesses an edge over competitors still stuck in manual processes.

Automated Planning for Growing Startups

Startups, in particular, benefit from the automation of business planning. Time is scarce, resources are limited, and every decision carries high stakes. Spending days buried in spreadsheets does not just waste productivity; it also risks slowing down execution.

Automated business planning with AI allows founders to keep their attention where it matters most: scaling the business. With tools like LivePlan, Finmark, and Brixx, finance ceases to be a bottleneck. Instead, budgeting and forecasting become growth enablers. These platforms democratize access to sophisticated financial planning by putting CFO-level insights into the hands of any entrepreneur, regardless of financial expertise.

From Reactive to Predictive Finance

The bigger story behind AI budgeting tools is the cultural shift from reactive finance to predictive finance. In the past, businesses waited for problems to surface in their numbers before responding. Now, predictive forecasting highlights potential shortfalls, cash flow squeezes, or revenue gaps before they become emergencies.

For example, if your AI budgeting platform forecasts that rising operating costs will outpace revenue three months from now, you have time to cut expenses, renegotiate contracts, or seek financing before a crisis hits. This proactive approach transforms budgeting from a dreaded annual task into a continuous strategic advantage.

The Edge That AI Provides

The end of manual budgeting does not mean the end of discipline; it means the rise of smarter discipline. Budgets are still necessary guardrails, but instead of being rigid constraints, they evolve as a business evolves. This flexibility enables leaders to experiment, test new ideas, and course-correct quickly without being handcuffed by outdated numbers.

More importantly, AI-driven budgeting tools bring clarity. In fast-moving markets where uncertainty is the norm, that clarity allows founders and operations leaders to navigate complexity with confidence. Whether it is planning headcount, evaluating funding needs, or preparing for growth, smart forecasting ensures decisions are grounded in real-time data and predictive insights.

Before we conclude, if you are an online business owner struggling with sales, or want to make money online and need free training tools and tactics to set your business on the path to success and profitability, click on the following link to join our free membership clubs. Whether you are stuck on traffic, struggling with content, or do not even know what to sell, there is a solution here.

Conclusion: The Future of Budgeting is Automated

Manual budgeting is becoming a relic of the past. AI-powered financial forecasting is not just a trend. It is the new standard for startups and growing businesses. Platforms like LivePlan, Finmark, and Brixx are leading the way, offering automation that saves time, reduces error, and provides predictive intelligence.

In an era where competitive advantage often comes down to how quickly and accurately you can make decisions, relying on static spreadsheets simply will not cut it. Businesses that embrace AI budgeting tools are not only saving time; they are gaining foresight. And foresight, in today’s economy, is everything.

The author, Stephen Aikins, has over two decades of experience working in various capacities in financial and business management, government, and academia. As a seasoned financial and management professional with a wealth of experience spanning diverse industries, he provides AI-powered digital solutions with data-driven insights to help enhance business growth. Additionally, he has prior experience offering strategic guidance and practical solutions to address a wide range of challenges and opportunities, including auditing and financial analysis, business planning, and organizational development.

The information presented in this blog is based on the author’s independent research and is for educational purposes only. At the time of writing, the author is not affiliated with any vendors of the AI tools and platforms mentioned in this blog. The links to these AI tools and platforms have been presented in the blog to enable readers to access, research, and make their own informed decisions.