For many small business owners, building credit feels like a badge of legitimacy; a signal to lenders, investors, and suppliers that you are running a serious operation. Strong business credit unlocks better loan terms, higher credit lines, and credibility with vendors. But the road to building that profile is littered with pitfalls. Too often, well-meaning entrepreneurs fall into what we will call the “business credit trap”—avoidable mistakes that can stall growth or even harm a company’s future prospects.

The good news? With smart planning, real-world awareness, and the help of AI-powered financial tools, you can sidestep these errors and keep your credit profile working for you, and not against you.

In this piece, we take you through the various business credit mistakes committed by business owners, the actions needed to avoid these mistakes, and the AI tools that can be leveraged to sidestep the mistakes and set your business on the path of strong credit and business growth.

Before we continue, if you are a business owner struggling with sales, or want to make money online and need free training tools and tactics to set your business on the path to success and profitability, click on the following link to join our free marketing membership clubs. Whether you are stuck on traffic, struggling with content, or do not even know what to sell, there is a solution here.

Overleveraging Business Credit Cards

One of the most common business credit mistakes is overreliance on credit cards. Business credit cards are valuable for managing cash flow, tracking expenses, and even earning rewards, but they can become dangerous when they are used as a primary funding source. Carrying high balances month after month not only racks up interest but also hurts your business credit utilization ratio, a major factor in your credit score.

It is easy to get caught up in the flexibility cards provide, but lenders view heavy card usage as a sign of instability. The trap here is thinking you are keeping the lights on while quietly undermining your creditworthiness. A healthier approach is to use credit cards for operational spending while relying on structured financing—like term loans or lines of credit—for larger, recurring needs.

AI tools can help monitor this balance. Platforms like Ramp automatically flag spending patterns that might lead to overleveraging, helping you keep utilization in check while identifying smarter ways to allocate expenses.

Missing UCC Filings and Liens

Another overlooked credit pitfall involves Uniform Commercial Code (UCC) filings. When you take out secured financing, lenders often file a UCC lien against your business assets. These filings can remain active even after the loan is paid off, creating the false impression that your company is still heavily leveraged. Left unchecked, old liens can spook future lenders or reduce your borrowing capacity.

Too many business owners are unaware of these filings or assume they disappear automatically. They do not. You have to follow up with lenders or file termination requests to clear them.

This is where AI credit monitoring tools like Nav step in. Nav provides ongoing visibility into your business credit reports, alerting you to any active liens or filings that could affect your profile. Instead of being blindsided during a loan application, you can proactively resolve issues and present a cleaner financial picture to lenders.

Mixing Personal and Business Credit

It is tempting, especially in the early stages, to blur the lines between personal and business finances. Swiping your personal credit card for a company expense feels harmless, but it can become a trap that delays your ability to build a distinct business credit profile. Worse, if the business struggles, your personal credit score, and potentially your personal assets, are on the line.

The separation of personal and business credit is foundational. Open dedicated accounts, use business credit cards responsibly, and make sure vendors and lenders report to commercial credit bureaus like Dun & Bradstreet. Only then can your business credit stand on its own.

AI-driven platforms like Nav provide unique insights here. Nav analyzes your real-time financial transactions, helping you build a stronger credit profile without inadvertently damaging your personal score. For founders eager to protect their personal credit while scaling their business, these tools are essential.

Ignoring Payment Reporting Opportunities

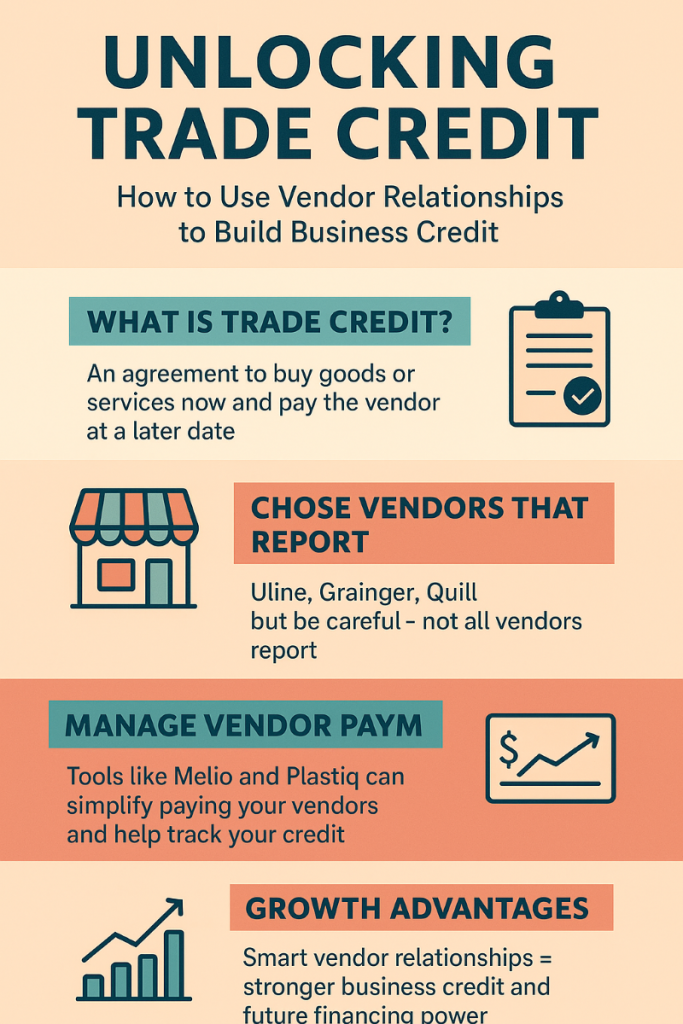

Many small businesses work with vendors or suppliers on net-30 or net-60 terms, but not all realize that these trade relationships can build credit if they are reported. Too often, entrepreneurs miss out on credit-building opportunities simply because they do not verify whether their vendors report to business credit bureaus.

Failing to leverage trade credit reporting is like leaving free credit history on the table. By contrast, consistently paying reported vendors on time can boost your business credit score quickly and reliably.

AI finance tools like Plastiq make this even easier by automating vendor payments, ensuring timeliness and accuracy. When coupled with proactive selection of reporting vendors, these tools transform ordinary bills into powerful credit-building assets.

Neglecting Regular Credit Monitoring

Another critical mistake is assuming that business credit works like personal credit: set it and forget it. In reality, business credit scores are more dynamic and can be affected by factors beyond your control, such as incorrect data or even fraud. A single error can drag down your score and sabotage funding applications.

Too many businesses discover these issues only when it is too late, after being denied for financing. Ongoing monitoring is essential. Nav offers a real-time dashboard that tracks your score, notifies you of changes, and helps you identify opportunities to improve. This proactive stance can mean the difference between being rejected for a loan and securing growth capital at favorable terms.

Overlooking Cash Flow in the Credit Equation

Finally, one of the most damaging traps is believing that credit scores alone determine financing outcomes. Lenders today look far beyond scores—they are evaluating real-time cash flow, revenue consistency, and operational health. Businesses that focus only on credit scores without strengthening cash flow management often hit walls during underwriting.

This is why integrating AI-powered forecasting tools is vital. Tools like Pulse and Float not only track cash flow but also predict future shortfalls, helping you plan funding needs before they become urgent. By pairing strong credit practices with sound cash flow management, you present lenders with the complete picture they want to see.

Before we conclude, if you are looking to start an online business that is Done For You with ongoing support, or you want to make money online but do not know where to start, then look no further. Click on the following link and learn more. To your success.

https://SteveAikinsOnline.com/survey.php

Conclusion: Avoiding the Credit Trap

The business credit trap is not one big misstep. It is a series of small, often invisible mistakes that compound over time. Overleveraging cards, ignoring UCC filings, mixing personal and business credit, overlooking vendor reporting, failing to monitor scores, and neglecting cash flow are all avoidable pitfalls.

The path forward is about more than discipline—it is about visibility. By embracing AI-powered monitoring platforms like Nav, automating payments with tools like Plastiq, and forecasting with Float or Pulse, you protect your business against the traps that quietly stall growth.

Strong business credit is not just about securing loans; it is about building a foundation for long-term success. Avoid the traps, embrace smart tools, and you will turn credit from a stumbling block into a springboard for growth.

The author, Stephen Aikins, has over two decades of experience working in various capacities in financial and business management, government, and academia. As a seasoned financial and management professional with a wealth of experience spanning diverse industries, he provides AI-powered digital solutions with data-driven insights to help enhance business growth. Additionally, he has prior experience offering strategic guidance and practical solutions to address a wide range of challenges and opportunities, including auditing and financial analysis, business planning, and organizational development.

The information presented in this blog is based on the author’s independent research and is for educational purposes only. At the time of writing, the author is not affiliated with any vendors of the AI tools and platforms mentioned in this blog. The links to these AI tools and platforms have been presented in the blog to enable readers to access, research, and make their own informed decisions.