When you launched your AI-driven business startup about a year ago, you knew speed was everything. The market was heating up, competitors were emerging every month, and your product roadmap needed funding fast. You had two clear paths: apply for a traditional startup loan or explore revenue-based financing (RBF), a newer model that ties repayment to your business’s actual performance.

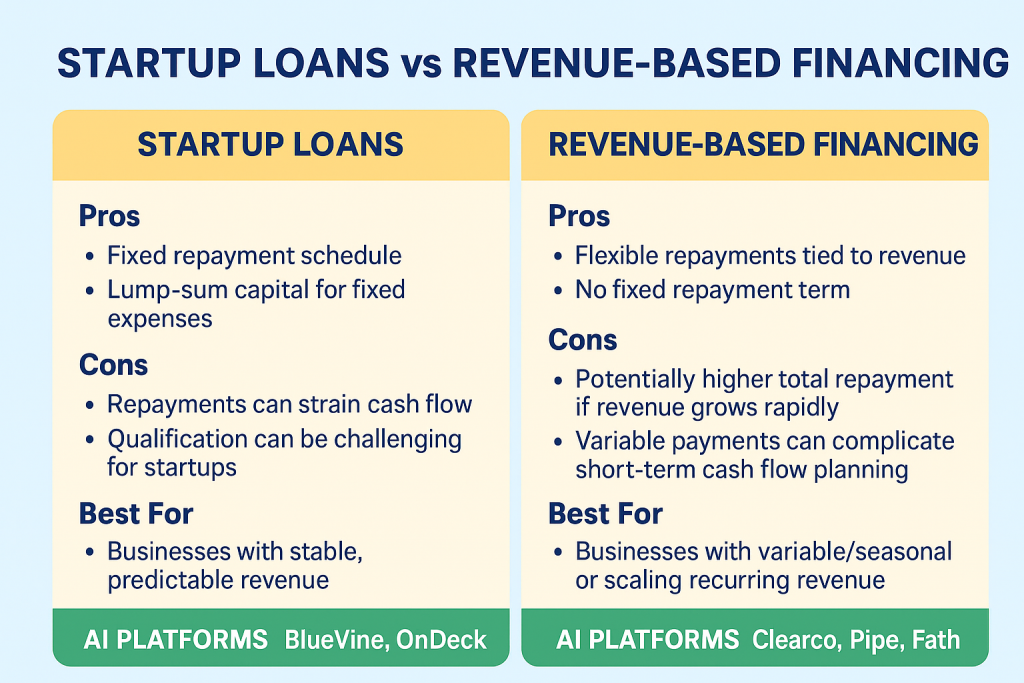

Both options have merit. A startup loan could give you a lump sum of predictable capital. Revenue-based financing could give you flexibility if your sales take longer to ramp up. In the modern AI economy, where cash moves faster than ever, and algorithms decide approvals in seconds, the reality facing startup owners is that the right choice is not just about rates or terms. It is about matching the funding model to the rhythm of your business.

In this piece, we discuss, compare, and contrast startup loans and revenue-based financing, and how you can leverage specific AI tools to help make informed decisions about your business funding. Before we continue, if you are looking to make extra money online or to have an online business that is Done For You with ongoing support, then look no further. Click on the following link and learn more. To your success.

https://SteveAikinsOnline.com/survey.php

The AI-Driven Evolution of Startup Loans

Startup loans have long been the first stop for early-stage founders who want stability. In the past, securing one meant long applications, in-person meetings, and weeks of underwriting. But in the AI economy, fintech lenders have cut that time down to hours.

For example, as a startup owner, you could explore BlueVine, a platform that uses AI underwriting to evaluate business health in real time. Instead of drowning in paperwork, you can connect your banking and accounting data directly to BlueVine. The AI scans your cash flow history, recurring payments, and customer base, then makes an instant decision, offering you terms within the same day.

Similarly, OnDeck uses predictive models to assess not just current revenue, but also the probability of repayment based on industry trends, payment history, and even seasonality in sales. This means you can see exactly how much capital you qualify for without risking a hard hit to your credit.

The Rise of Revenue-Based Financing in the AI Economy

While loans give you predictability, they also lock you into fixed monthly payments, no matter how your business is performing. For startups, that is a concern. If your product launch is staggered, your revenue may ramp in bursts, and not a steady climb. In such an instance, exploring revenue-based financing may be a good option.

In RBF, you get upfront capital and repay it as a fixed percentage of your monthly revenue. If you earn more, you pay more that month; if you earn less, you pay less. There is no set repayment date, just a target multiple (for example, paying back 1.2x or 1.5x the original amount).

Clearco, an AI-powered RBF platform that has funded thousands of e-commerce and SaaS companies. Clearco’s algorithms can pull your revenue streams from Stripe and your bank accounts, predicting future growth and determining exactly how much capital they could advance, without equity dilution.

Another option to consider is Pipe, which takes a slightly different approach by turning recurring revenue streams into tradable assets. Using Pipe’s marketplace, you could sell your predictable revenue to investors for upfront cash, bypassing traditional debt entirely.

Flexibility vs Predictability: The Trade-Off

It is important to consider your business situation carefully to make an informed choice regarding your business funding. Startup loans offer you a predictable schedule, which makes planning easier. But if your revenue dipped, those fixed payments could become a strain. On the other hand, RBF offers flexibility, payments scaled with performance, but the total repayment could end up being higher than a loan if your business grows faster than expected.

To run the numbers, you can turn to Fathom for scenario modeling. For example, you can use Fathom to set up three projections: one for a fixed loan repayment plan, one for revenue-based payments in a slow-growth scenario, and one in a rapid-growth scenario. Fathom’s AI models can review your industry’s general situation and provide guidance. For example, the AI models may highlight that in your industry, where sales velocity could spike unpredictably, RBF might save you from cash crunches, even if it costs a bit more over time.

How AI Is Leveling the Playing Field

The most remarkable part of your decision-making process was how much of it can be driven by AI insights, not gut feeling. In the past, small business owners relied on manual spreadsheets, rough forecasts, and weeks of banker calls. Now, platforms like BlueVine, Clearco, and Pipe can analyze thousands of data points in seconds.

Even compliance and risk evaluation have gone digital. Nav can give you a real-time business credit score and suggest ways to improve it, and then pre-qualify you for both loan and RBF options based on your profile.

This AI-driven transparency means you can see exactly what each funding option would cost, how quickly you could access it, and the potential risk, without hidden clauses buried in contracts.

Making the Choice in the AI Economy

Based on your start-up business type, revenue model, and growth projections, you may decide on a start-up loan, RBF or a hybrid approach. With the hybrid, you may take a smaller start-up loan from BlueVine to cover fixed operational expenses and pair it with a Clearco RBF agreement to fund your marketing and customer acquisition push. In such a situation, the fixed loan gives you predictable cash for core expenses, and the RBF gives you flexibility for growth.

By leveraging AI-driven fintech platforms, you could avoid the trap of over-leveraging on one type of funding. More importantly, you could build a financing strategy that could adapt as quickly as the AI-driven market around you.

Before we conclude, please do not forget to click on the link below if you are looking to make decent money online or are looking to have an online business that is Done For You with ongoing support.

https://SteveAikinsOnline.com/survey.php

Final Takeaway: Funding Demands More Than Just Capital

In the AI economy, choosing between startup loans and revenue-based financing is less about tradition and more about fit. AI-powered fintech platforms have removed much of the friction from both options, but the right choice depends on your revenue model, growth projections, and tolerance for repayment flexibility.

For founders, the smartest move is not choosing one over the other; it is using AI-driven insights to combine funding options in a way that amplifies growth while protecting cash flow. In the current AI economy, it is important for your funding strategy to be as agile as your business.

The author, Stephen Aikins, has over two decades of experience working in various capacities in financial and business management, government, and academia. As a seasoned financial and management professional with a wealth of experience spanning diverse industries, he provides AI-powered digital solutions with data-driven insights to help enhance business growth. Additionally, he has prior experience offering strategic guidance and practical solutions to address a wide range of challenges and opportunities, including auditing and financial analysis, business planning, and organizational development.

The information presented in this blog is based on the author’s independent research and is for educational purposes only. At the time of writing, the author is not affiliated with any vendors of the AI tools and platforms mentioned in this blog. The links to these AI tools and platforms have been presented in the blog to enable readers to access, research, and make their own informed decisions.