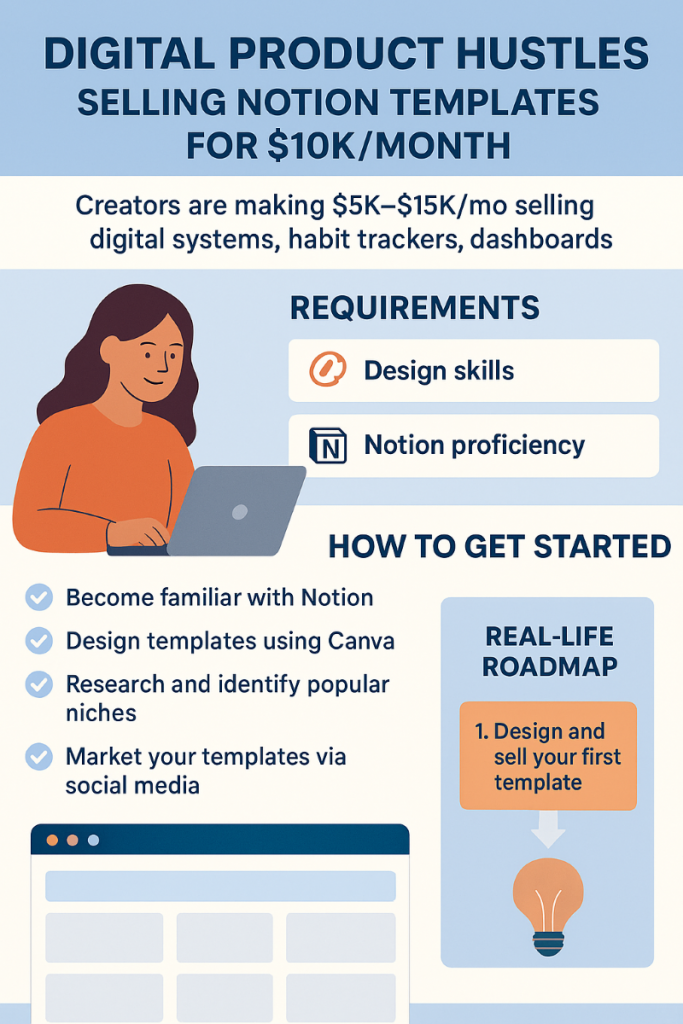

Selling digital products is one of the fastest-growing online side hustles, and among them, Notion templates have become a breakout star. From productivity dashboards to habit trackers and business planning systems, creators are turning simple Notion layouts into consistent monthly income streams.

Platforms like Etsy and Gumroad make the process easier than ever, offering accessible marketplaces with low competition compared to traditional e-commerce. With the right approach, it is possible to turn template creation into a profitable business that runs with a mix of creativity, automation, and smart marketing.

In this piece, we discuss the rise of Notion templates and walk you through the roadmap for designing and selling those templates. Additionally, we present a set of AI tools capable of powering the design and sale of Notion templates.

Designing and selling Notion templates is a good opportunity to make money online. Alternatively, if you are looking to start an online business that is Done For You with ongoing support, or you want to make money online but do not know where to start, then click on the following link to learn learn of such opportunity. To your success.

https://SteveAikinsOnline.com/survey.php

Why Notion Templates Sell in 2025

Notion has exploded into the go-to tool for personal and business organization. Its flexibility allows users to create custom workflows, but many do not want to spend the time designing systems from scratch. That is where templates shine. A clean, ready-to-use template saves buyers hours and adds instant value.

On Etsy, buyers already search for productivity tools, planners, and digital downloads. With over 90 million active buyers, Etsy is a marketplace that thrives on impulse purchases. Meanwhile, Gumroad appeals to indie creators who want a lightweight way to sell digital products directly to an audience without managing their own website. Both platforms handle payment, delivery, and exposure, allowing sellers to focus on creating and marketing templates.

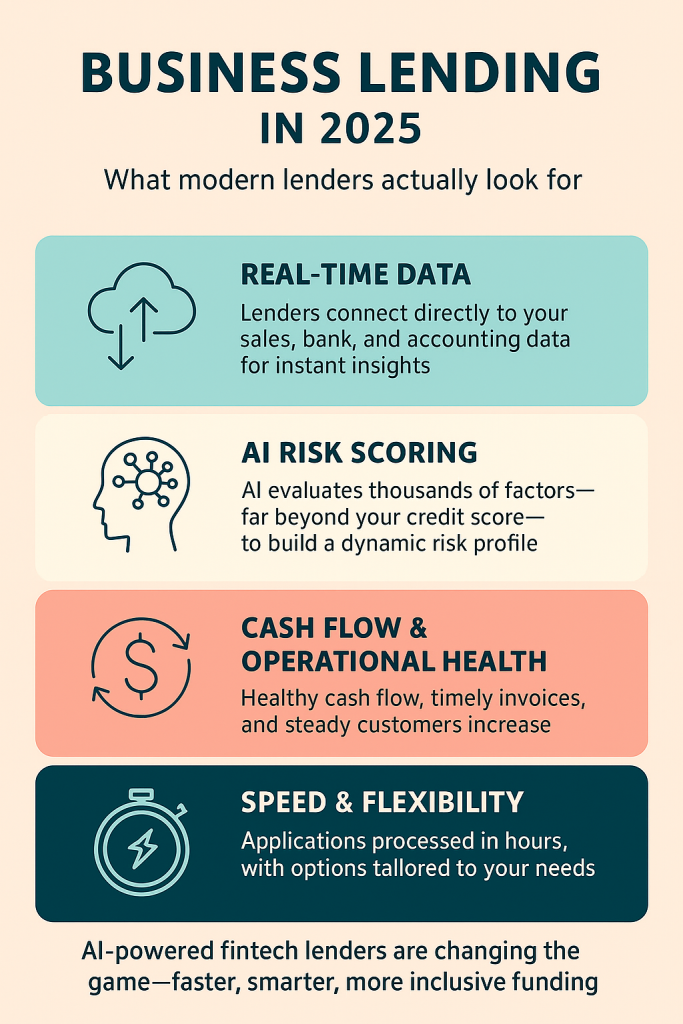

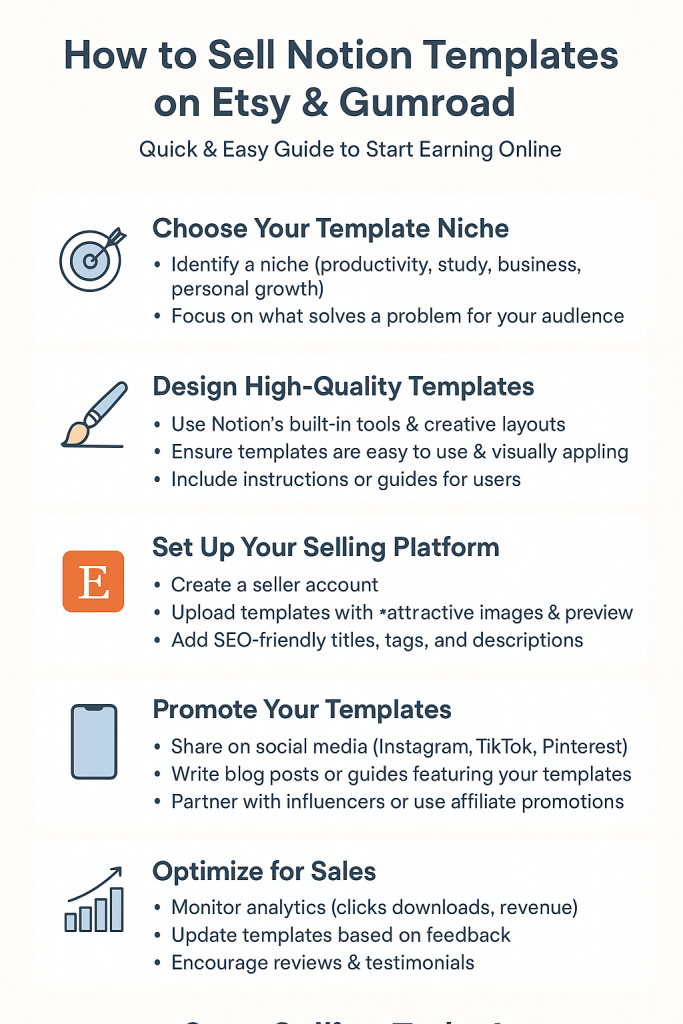

Step One: Finding Your Niche

The first step to building a sustainable template business is choosing the right niche. Instead of making generic planners, successful sellers focus on specific audiences. For instance, a “Student Success Dashboard” targets college students managing coursework, while a “Small Business Finance Tracker” resonates with entrepreneurs.

AI tools like ChatGPT help brainstorm niches by analyzing trends, suggesting underserved audiences, and generating template ideas. By asking ChatGPT for “emerging Notion template categories on Etsy,” you can instantly generate a roadmap of potential products.

Step Two: Designing Templates That Sell

The design of a template often determines whether it sells or sits unnoticed. Beyond functionality, aesthetics matter. Templates with clean visuals, structured layouts, and custom icons stand out.

Creators often use Figma or Canva to design color palettes, covers, and icons before importing them into Notion. For an extra layer of polish, MidJourney generates custom graphics that align with a product’s theme, whether it is minimalist productivity or bold student planners.

By combining these tools, sellers create templates that look professional and feel intuitive, giving buyers confidence that they are purchasing a premium product.

Step Three: Setting Up Shop on Etsy

Etsy remains one of the best discovery platforms for digital products. To succeed there, sellers optimize listings with SEO keywords such as “Notion template,” “student planner,” or “business finance dashboard.” Descriptions need to communicate not just features but outcomes: how the buyer’s life will improve.

Tools like eRank analyze Etsy SEO performance, helping sellers identify high-demand, low-competition keywords to target. By embedding these phrases naturally in product titles and tags, templates gain visibility.

High-quality listing images are also essential. Canva templates showing the Notion layout on laptops or phones give buyers a real-world sense of how the template will look in use. Adding a short demo video increases conversions significantly.

Step Four: Selling Directly on Gumroad

While Etsy brings buyers through its marketplace, Gumroad is a direct-to-consumer platform. It is perfect for creators who already have audiences on TikTok, Twitter, or YouTube. Setting up a Gumroad page takes minutes, and with AI-enhanced tools like Typedream or Framer, sellers can design sleek landing pages that integrate directly with Gumroad checkout.

Gumroad also makes pricing experiments easy. Creators often test “pay what you want” models, letting buyers choose their price. This approach builds goodwill while sometimes yielding higher revenue than fixed pricing. With Zapier integrations, Gumroad connects to email marketing tools like Kit, automating delivery and nurturing repeat customers.

Step Five: Marketing Your Templates

Templates do not sell themselves. Creators use content-driven marketing to attract attention. TikTok videos showing how a template works in real life or Twitter threads outlining productivity hacks are particularly effective.

Tools like OpusClip turn long-form demo videos into viral-ready TikTok clips, while VidIQ helps optimize YouTube tutorials with SEO-driven tags and descriptions. Social proof also matters—sharing testimonials or user-generated content builds credibility and drives organic sales.

Email marketing remains a key driver of repeat business. Offering free mini-templates in exchange for email signups creates a funnel for selling premium products later. Gumroad and Etsy both integrate seamlessly with these campaigns.

Step Six: Scaling to $10K/Month

Once sellers find their first winning template, scaling becomes a matter of consistency and systemization. Top creators batch design new templates, release bundles, and use upsells to increase order value. A $10 planner becomes part of a $39 “Ultimate Student Toolkit” with multiple dashboards, significantly boosting revenue.

Automation is the hidden engine of scaling. With Zapier workflows, creators can automatically tag customers, trigger onboarding emails, and deliver bonus resources. Meanwhile, analytics tools inside Gumroad and Etsy reveal which templates perform best, guiding future design decisions.

Some sellers even expand to affiliate marketing, where other creators promote their templates in exchange for a commission. This widens reach without requiring extra marketing work.

Real Success Stories

Across Reddit, Twitter, and YouTube, creators share their journeys from side hustle to full-time income. One Notion creator scaled a student productivity bundle to $12,000/month on Etsy by consistently posting TikTok tutorials and optimizing listings with eRank. Another reached $15,000/month on Gumroad by building a strong email funnel and bundling multiple finance dashboards into premium packages.

These stories prove the model works, but they also highlight the importance of treating template selling as a real business. Success does not happen by accident—it is the result of intentional design, SEO strategy, and AI-powered marketing.

The Future of Notion Template Businesses

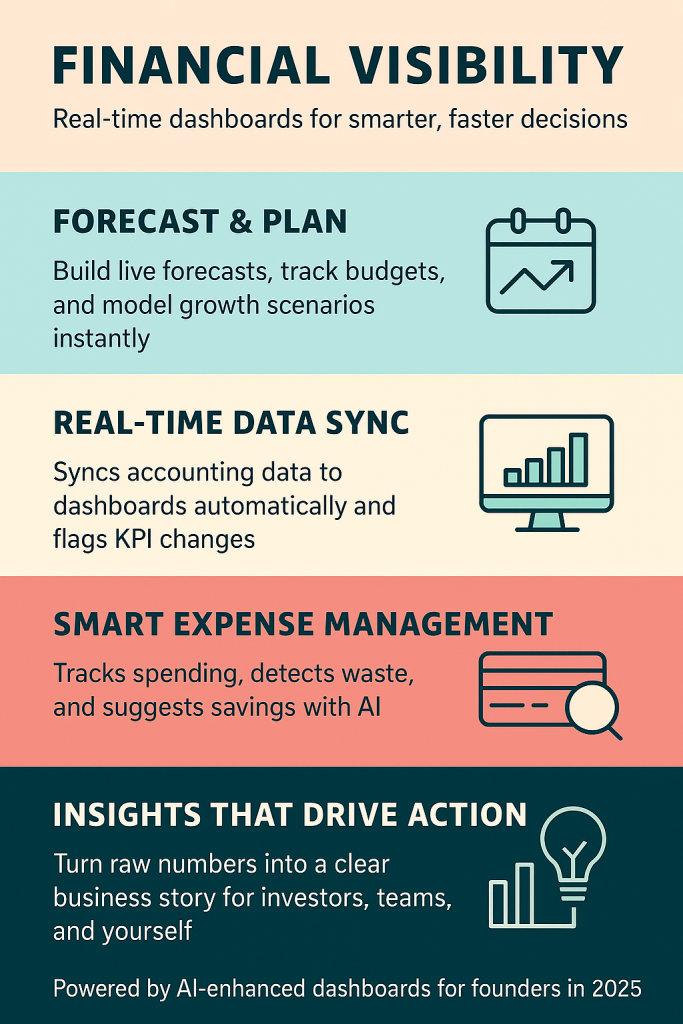

As AI evolves, templates will become smarter. Imagine habit trackers that update automatically based on wearable device data or business dashboards that integrate with real-time accounting software. Platforms like Notion are already experimenting with AI-assisted task creation, meaning templates themselves may soon offer predictive features.

For creators, this represents both a challenge and an opportunity. Those who innovate early will capture growing demand for intelligent, dynamic templates. The foundation remains the same: identify buyer pain points, design elegant solutions, and use platforms like Etsy and Gumroad to deliver them at scale.

Before we conclude, if you want to discover the mindset hacks you need to be a highly successful entrepreneur, to get the eye-opening strategies that will have you act and think like a CEO, and most importantly, to gain the ability to effectively manage your money as an entrepreneur, then click the link below to join our free success upgrade membership club. From managing money to leading a team, this membership is about equipping you with the right entrepreneurial mindset.

https://SteveAikinsOnline.com/successupgrade

Final Thoughts

Selling Notion templates on Etsy and Gumroad combines the best of the digital economy: low overhead, passive income potential, and scalable growth. With AI tools simplifying everything from design to marketing, anyone with creativity and consistency can build a profitable template business.

The path from your first $10 sale to $10K/month is not theoretical—it is already being walked by creators worldwide. The opportunity is here. The only question is: will you design your first template and step into this growing marketplace?

The author, Stephen Aikins, has over two decades of experience working in various capacities in financial and business management, government, and academia. As a seasoned financial and management professional with a wealth of experience spanning diverse industries, he provides AI-powered digital solutions with data-driven insights to help enhance business growth. Additionally, he has prior experience offering strategic guidance and practical solutions to address a wide range of challenges and opportunities, including auditing and financial analysis, business planning, and organizational development.

The information presented in this blog is based on the author’s independent research and is for educational purposes only. At the time of writing, the author is not affiliated with any vendors of the AI tools and platforms mentioned in this blog. The links to these AI tools and platforms have been presented in the blog to enable readers to access, research, and make their own informed decisions.