When Elena launched her marketing consultancy in two years ago, she didn’t think much about her business credit card. It was simply a tool for paying vendors, booking travel, and buying software subscriptions. But two years later, after a costly fraud incident drained her account for weeks before being reimbursed, she realized she needed something more secure—something faster, smarter, and less vulnerable to compromise.

That is when she discovered virtual business credit cards, a fintech innovation that is reshaping the way companies spend. In the current AI economy, these digital cards are more than a security upgrade. They are an AI-powered spending control center.

In this piece, we discuss the features and benefits of virtual business credit cards, such as fraud protection, spending controls, and real-time tracking of transactions, and the AI-powered tools that enable these benefits. Before we continue, if you are looking to make money online or to have an online business that is Done For You with ongoing support, then look no further. Click on the following link and learn more. To your success.

https://SteveAikinsOnline.com/survey.php

From Plastic to Pixels: Why Virtual Cards Are Surging

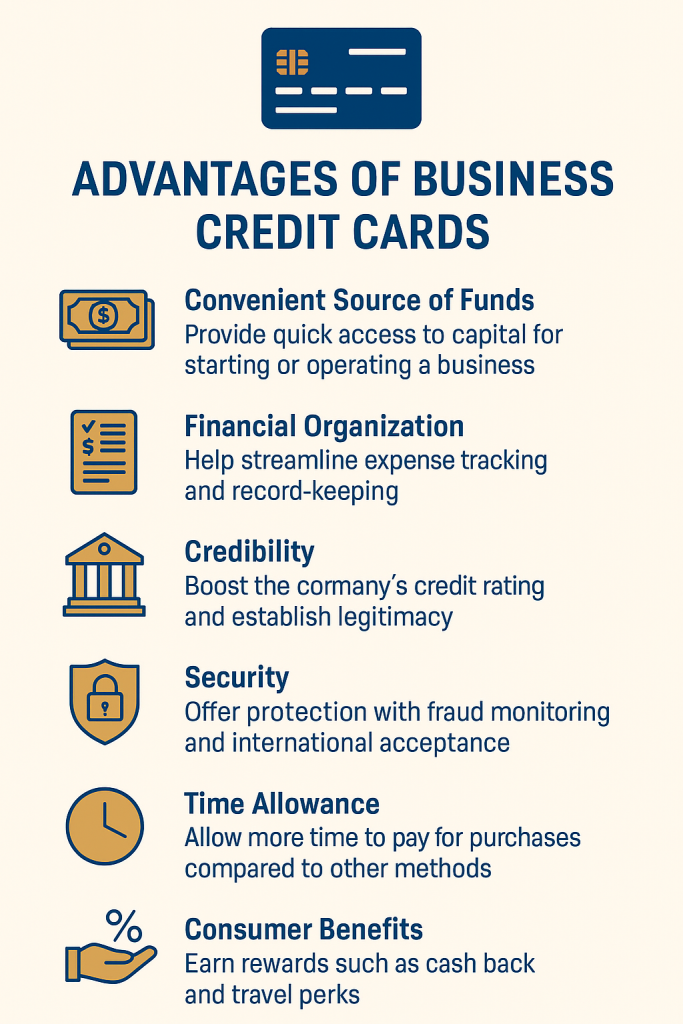

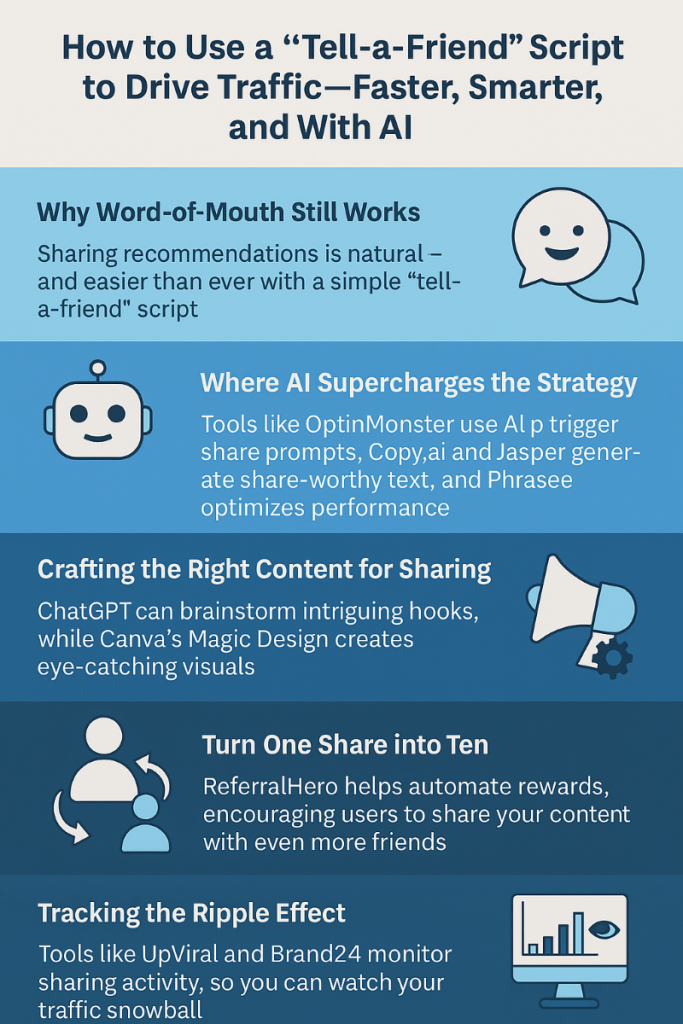

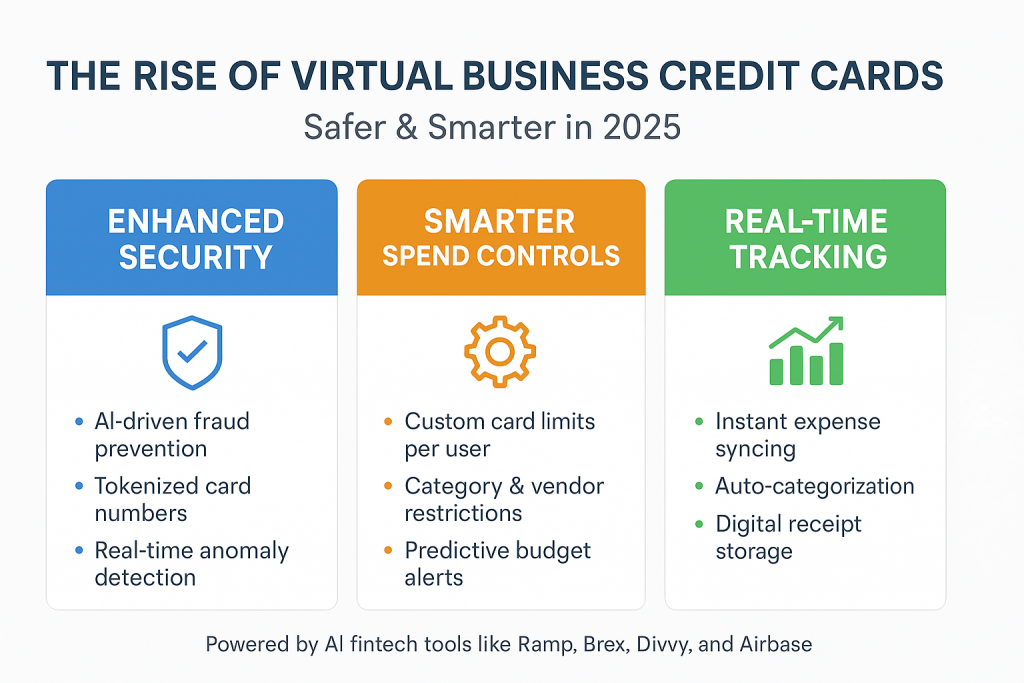

A virtual business credit card functions much like a traditional one, except it lives entirely online. Instead of a physical card number, you receive a unique, tokenized number that can be generated for a single purchase, a specific vendor, or a recurring subscription. This shift from plastic to pixels is more than just convenience; it is security by design.

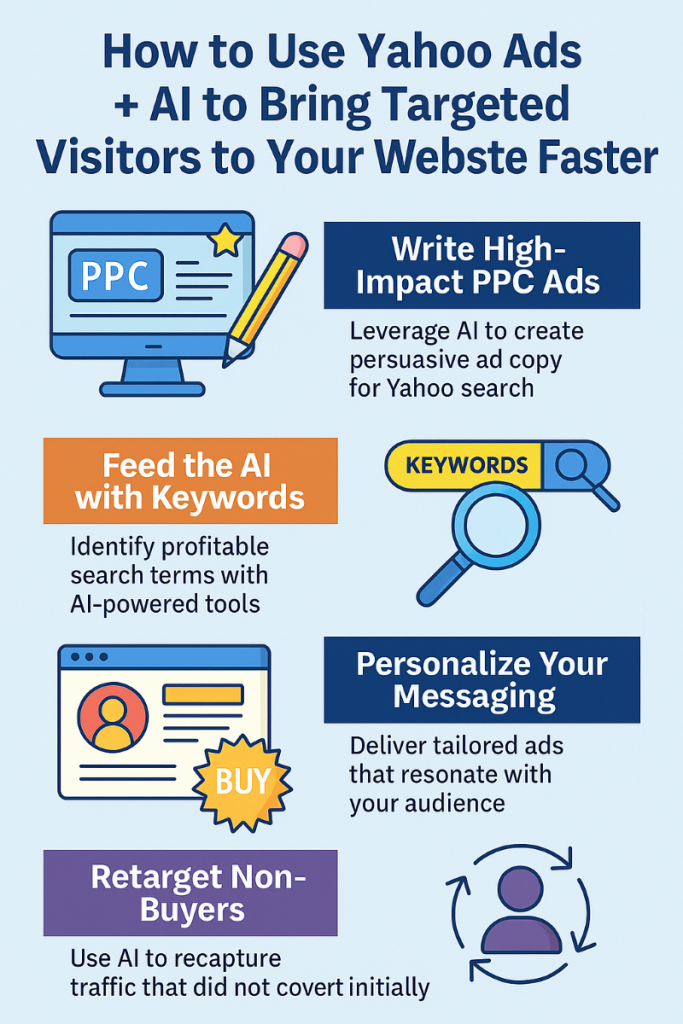

Ramp is an AI-driven platform that enables seamless creation of multiple virtual cards coupled with security through fraud protection. The AI behind Ramp continuously scans transactions for unusual patterns, flagging anything suspicious before it becomes a problem. Unlike traditional credit cards, where fraud alerts often come after the fact, Ramp’s real-time monitoring prevents unauthorized charges from even posting.

AI Fraud Protection: A Smarter Shield for Business Credit Card Security

The biggest selling point of virtual credit cards is AI-driven fraud prevention. Platforms like Brex integrate machine learning models that learn your company’s typical spending habits. If a card meant only for advertising spending on Google is suddenly used for a software license in another country, the AI flags and freezes it instantly.

For a business owner, that means your peace of mind. Knowing that every transaction is checked in real time by algorithms trained to detect anomalies could be a game-changer in that it is not just fraud detection, but also fraud prevention.

Smart Spending Controls: The CFO in Your Pocket

Beyond security, virtual business credit cards are redefining how companies manage budgets. For example, instead of giving one physical card to multiple team members, you can issue individual virtual cards with precise controls—$500 per month for a social media coordinator, $1,200 for software subscriptions, and unlimited access for your operations manager’s approved vendors.

Tools like Divvy make this possible. Divvy’s AI not only enforces spending limits but also provides predictive spend analytics. This means you could see, halfway through the month, whether a budget is at risk of overspending and adjust accordingly. It is like having a CFO who watches every purchase and forecasts where you’re headed.

Real-Time Tracking and Accounting Integration

One of the benefits of moving to virtual business credit cards is the speed of reporting. With physical cards, expenses often sit unreported until receipts are submitted, creating a lag in a company’s financial picture. With platforms like Airbase, every transaction can be synced instantly to your accounting software.

The AI does not just capture the amount—it categorizes expenses, matches them to the right budget line, and even attaches digital receipts. When tax season rolls around, you do not have to chase down missing information; it is already stored, tagged, and reconciled.

Are Virtual Business Credit Cards Safer? Absolutely—But That’s Only Half the Story

Security is a huge win, but in the AI economy, the real reason businesses are switching to virtual cards is the control and insight they bring. For a growing company, knowing exactly where every dollar goes is as important as preventing theft.

With AI platforms such as Ramp and Airbase, unnecessary subscriptions can be canceled within hours of being spotted. Overlapping vendor charges can be eliminated. And, most importantly, your team could make authorized purchases without waiting for approval emails or access to a shared corporate card.

Before we conclude, please do not forget to click on the following link to learn more if you are looking to make money online or to have an online business that is Done For You with ongoing support.

https://SteveAikinsOnline.com/survey.php

The Smarter Way Forward

For small and medium-sized businesses in the AI economy, virtual business credit cards offer a rare combination: enhanced security, granular control, and real-time visibility. By pairing them with AI-powered fintech platforms, companies are not just avoiding fraud; they’re actively shaping better financial habits.

Your journey from vulnerable to empowered can mirror what is happening across the business landscape. Virtual credit cards are not just the future, but they are the present. And in a digital economy where every transaction is data, the smartest businesses are using that data to protect, control, and grow their finances.

The author, Stephen Aikins, has over two decades of experience working in various capacities in financial and business management, government, and academia. As a seasoned financial and management professional with a wealth of experience spanning diverse industries, he provides AI-powered digital solutions with data-driven insights to help enhance business growth. Additionally, he has prior experience offering strategic guidance and practical solutions to address a wide range of challenges and opportunities, including auditing and financial analysis, business planning, and organizational development.

The information presented in this blog is based on the author’s independent research and is for educational purposes only. At the time of writing, the author is not affiliated with any vendors of the AI tools and platforms mentioned in this blog. The links to these AI tools and platforms have been presented in the blog to enable readers to access, research, and make their own informed decisions.